Bitcoin price action targets $28,500 with “all classes” buying BTC, but the odds of the Fed pausing rate hikes are dwindling by the hour.

Bitcoin Price Rise Despite Conservative Fed Views

Data from meritlives Markets Pro and TradingView show BTC/USD approaching $28,500 on Bitstamp.

The latest BTC price action is the latest in a series of multi-month highs and precedes what is expected to be a volatile day for the market.

The Fed will announce the amount, if any, of the benchmark rate hike on March 22nd.

“A potential swing to the highs, narrowing the CME gap, capturing everyone and creating a bearish divergence is an ideal concept. Keyzone $28,700.”

Nevertheless, Bitcoin made some interesting moves on the day, with the volatility of the rising dollar combined with dominance of the overall crypto market cap.

“Altcoins are bleeding as bitcoin is still consolidating near its highs. Not the sign you want to see,” Van de Poppe previously warned.

“Money turns from altcoins to bitcoin amid concerns about tomorrow’s FOMC meeting, and has been relatively calm in terms of positions. Obvious opportunities will arise. ”

The ensuing crash after Wall Street opened was described by popular trader Crypto Tony as an “interesting dump of BTC’s dominance causing a surge in altcoins.”

Mixed signals reflect the market vision of the Federal Open Market Committee (FOMC) meeting. According to CME Group’s FedWatch tool, a majority now predicts a rate hike of 25 basis points, as opposed to the moratorium previously favored.

“All Classes” Buy BTC

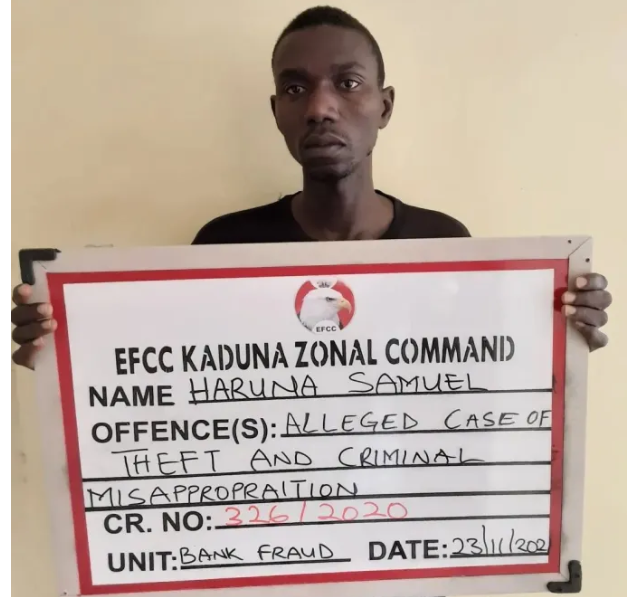

Meanwhile, analyzing trader behavior, on-chain monitoring resource Material Indicators revealed bulk purchases on the largest global exchange, Binance.

Related:

Will the Federal Reserve Stop Hiking Rates? 5 Things You Need To Know About Bitcoin This Week

A snapshot of the BTC/USD orderbook shows an increase in engagement for both large and small volumes ahead of the FOMC.

While $28,500 and $29,000 formed the strongest resistance levels at the time of writing, the next key support at $27,000 was further away from the spot price.